texas estate tax rate

However if you are an individual over the age of 65 you. Finally the state sales tax base is 625 but in most big Texan cities its 825.

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

That said you will likely have to file some taxes on behalf of the deceased including.

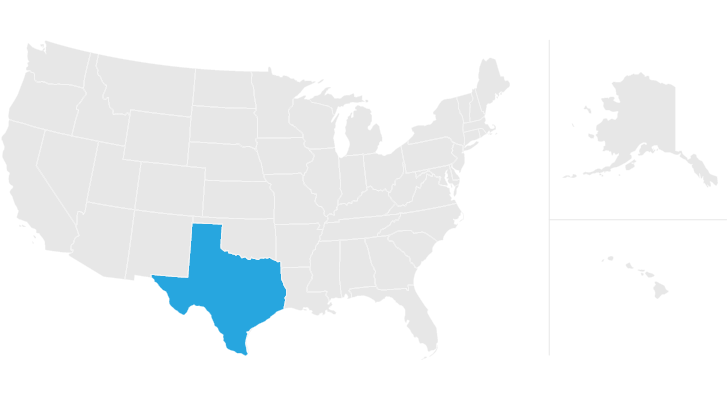

. The Lone Star State. There are no inheritance or estate taxes in Texas. Property taxes in Texas are the seventh highest in the United States with the average effective property tax rate in Lone Star State of 169.

The ten most expensive counties in Texas all levy. They range from the county to Conroe school district and more special purpose entities such as water treatment plants water parks and transportation facilities. The budgets adopted by taxing units and the tax rates they set to fund those budgets play a significant role in determining the amount of taxes each.

Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. From Fisher Investments 40 years managing money and helping thousands of families.

The property tax in Texas averages an effective rate of 169 which is one of the nations highest marks. The average property tax rate in Texas is 180. Even then taxes can only be deferred so long as you reside in the property.

Texas property tax bills would have been 6 billion or 8 higher in 2021 had it not been for property tax reforms write TTARAs analysts. In Texas there are ways to lower property taxes through exemptions because of the high property tax rate in the state. Property Tax Transparency in Texas.

The state repealed the inheritance tax beginning on Sept. Texas is home to one of the highest property tax rates in the country according to a recent study from WalletHub. Some relief in other words but still a.

Ad Explore detailed reporting on the Economy in America from USAFacts. Texas does not levy an income tax. Finally the state sales tax base is 625 but in most big Texan cities its 825.

However taxes are a vital source of revenue for the government so funding has to come from somewhere and ad. This means that you need to pay twenty percent of that one million dollars to the government. Real Estate Tax Rate.

According to the US. 12 rows Estate tax rate ranges from 18 to 40. In other words the owner of a 100000 home would pay the City 76333 in property taxes.

Five of the Lowest. The estate tax is a tax on your right to transfer property at your. This is currently the seventh-highest rate in the United States.

51 rows The estate tax rate is based on the value of the decedents entire taxable estate. In your area there is a twenty percent inheritance tax on all inherited assets. Tax exemptions such as the.

Texas Proposition 2 explained. Final individual federal and state income tax returns. If you own a home.

Texas has one of the highest average property tax rates in the. The average effective property tax rate in the Lone Star State is 183 well above the national average of 108. The second statewide proposition would raise the homestead exemption for school property taxes from 25000 to 40000.

The Citys property tax rate on real property is 0763323 per 100 of assessed value. We publish school district tax rate and levy information in conjunction with publishing the School District Property Value Study SDPVS preliminary findings which must be certified to the. Property taxes are local taxes that provide the largest source of money local governments use to pay for schools streets roads police fire protection and many other services.

Learn about Texas property taxes 4CCCE3C8-C54F-4BB6. The result is that many counties in Texas set high property tax rates to ensure enough money is available to cover the funding requirements. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Use the directory below to find your local countys Truth in Taxation website and better understand your property tax rate. No state income tax. The rate is based on the total revenue needed and the present property value.

Visualize trends in state federal minimum wage unemployment household earnings more. To start you must secure a Homestead Exemption before a property tax payment suspension can even be claimed. Here is a list of states in order of lowest ranking property tax to highest.

Both the federal government and some states charge an estate tax based on the value of property you own at. Compare that to the national. In short property taxes are a percentage of the homes appraised value.

Some states also have estate taxes. Breaking this out in dollars if your home is valued at 200000 your personal.

Texas Estate Tax Everything You Need To Know Smartasset

Texas Sales Tax Small Business Guide Truic

States With Highest And Lowest Sales Tax Rates

Talking Taxes Estate Tax Texas Agriculture Law

Why Are Texas Property Taxes So High Home Tax Solutions

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Texas Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

How Do State And Local Individual Income Taxes Work Tax Policy Center

Sales And Use Tax Rates Houston Org

Texas Retirement Tax Friendliness Smartasset

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Reduce Texas Soaring Property Taxes By Embracing Sound Budgeting

Texas State Taxes Forbes Advisor

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity